Numero Vat Colombia

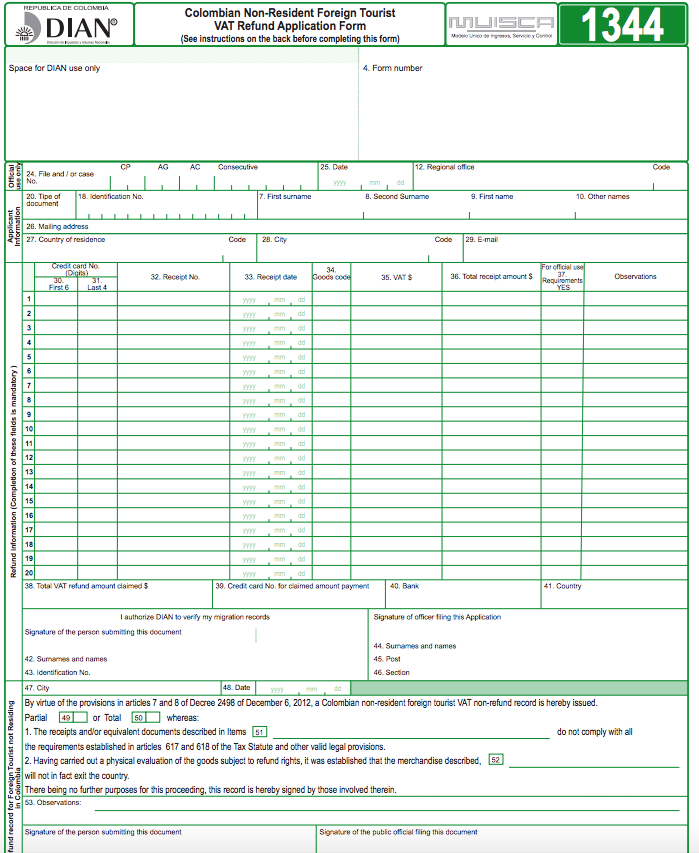

Answer 1 of 37 I would like to share this information with tourists so that they have a more positive experience than I did while attempting to claim the VAT tax on my purchases in Colombia Most shops add by law a 19% VAT tax If you are a foreign tourist and.

Numero vat colombia. The valueadded tax (VAT) is the main indirect tax This rose to 19 percent in 17;. Transforming waste into value;. 2 up to the end of 16 the tax was 16 percent of the price of merchandise, goods and services with some exceptions public transportation , water supply and sanitation and the transportation of natural gas and hydrocarbons.

Ideal to enjoy a long walk at sunset. En El Salvador recibe el nombre de NIT (Número de Identificación Tributaria) El número solo consta de caracteres numéricos y se caracteriza por el hecho que los seis números del centro coinciden con la fecha, mes y año de nacimiento del contribuyente Ejemplo XXXXXXXX (5 de noviembre de 1980). Si lo necesitas, puedes descargar una copia de nuestro formulario W9 y usar nuestro número de identificación de contribuyente (TIN, Taxpayer Identification Number) de los EE UU El Id de IVA de Dropbox International Unlimited Company es IE J.

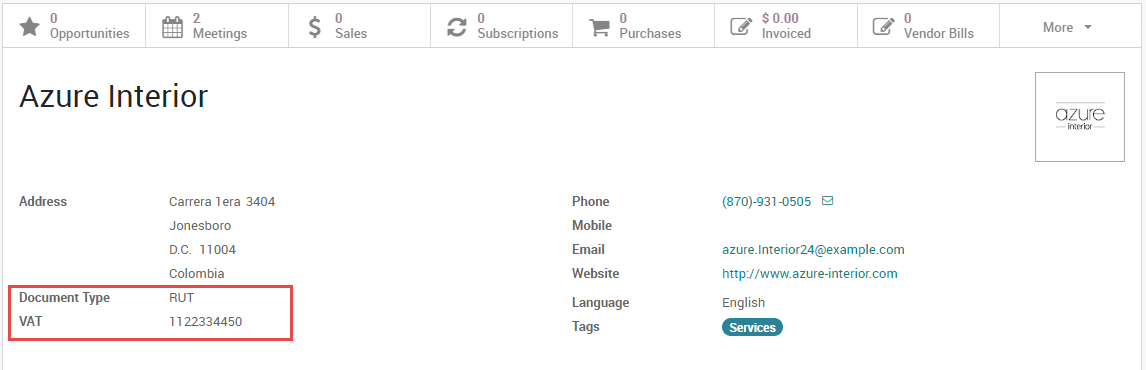

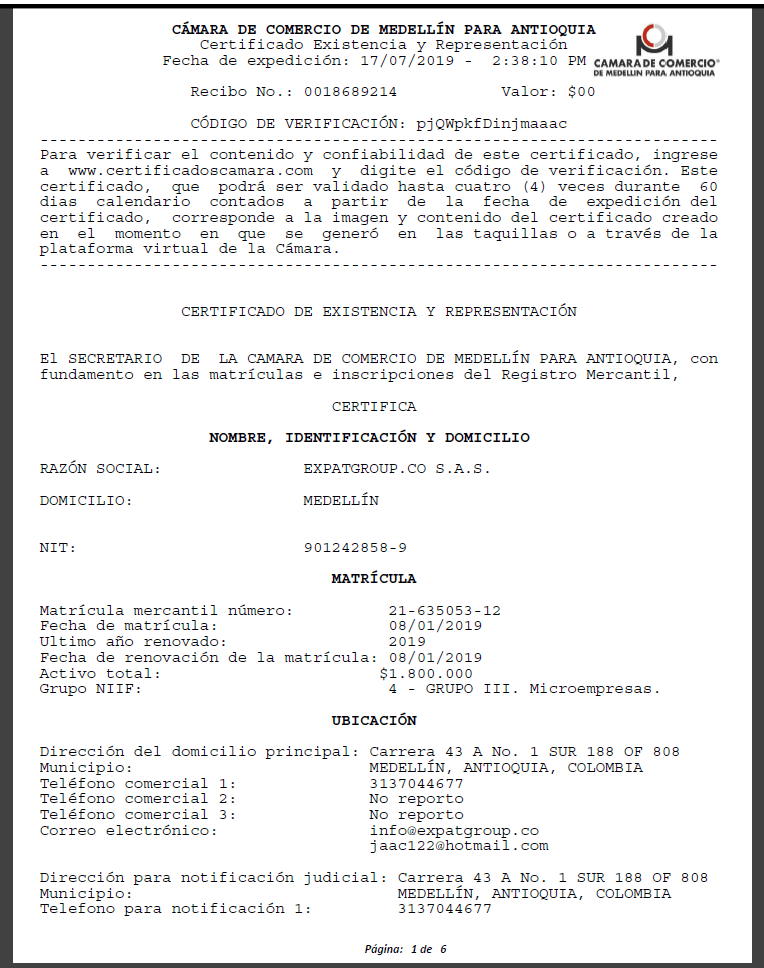

Colombia has a reverse charge mechanism, relevant to VAT responsible, when they have transactions with nonresidency in Colombia When overseas companies nonresidents provide their services to a nonresponsible of VAT, they are obliged to register in Colombia, file a VAT return and pay the VAT to the tax authority. Muy a menudo, el número de IVA será el único número de identificación fiscal en el país correspondiente Sin embargo, a veces, las autoridades fiscales pueden emitir dos números un número de impuesto local para las transacciones locales y comunicaciones con las autoridades fiscales;. Número de Identificación Tributaria assigned by the DIAN (Dirección de Impuestos y Aduanas Nacionales de Colombia) when the entity is registered in the RUT (Registro Único Tributario) It consists of 10 digits where the last one is a check digit in the format "" eg VAT numbers, national IDs, or general tax numbers.

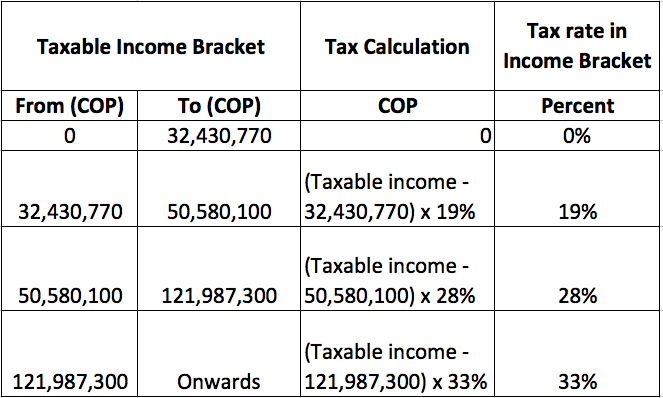

Calle Las Mercedes, 31 3º 430, Getxo (34) 944 800 500 sbal@sbalnet Contacto. Physically rendered in Colombia are subject to VAT Nevertheless, some exceptions are provided regarding services rendered from abroad by nonresidents to users or recipients located in Colombia, such as auditing, consulting, advisory and licensing of intangible goods, which are considered to be rendered in Colombia and therefore levied with VAT. Colombia has a relatively high VAT tax at 19 percent, which is a downside for living in the country But several other countries in Latin America also have a relatively high VAT So, Colombia isn’t unique in the region Fortunately for tourists, Colombia offers an IVA tax refund The refund is straightforward to apply for.

¿QUÉ ES EL NÚMERO VAT EN ESPAÑA?. Bolivia, Colombia, Panamá, El Salvador y Guatemala NIT Número de Identificación Tributaria) Argentina CUIT (Código Único de Identificación Tributaria Brasil CPF (Cadastro de Persona Física), o CNPJ (Cadastro de Persona Jurídica) Venezuela RIF (Registro de Información Fiscal) Chile RUT(Rol Único Tributario) Costa Rica. Persons and entities, without residence or domicile in Colombia, who provide services from abroad to Colombian tax residents are subject to VAT in Colombia Periodicity It must be presented and paid bimonthly The bimonthly fiscal periods are the following 1 January February 2 March April 3 May June 4 July August 5 September.

Using digital tools at the service of the environment;. Colombia has a national Valueadded tax (VAT) of 16% as of 21, administered by the Dirección de Impuestos y Aduanas Nacionales (DIAN) Visit this page for an executive summary of Colombia's tax structure and rates, by SalesTaxHandbook. Por primera vez en Colombia se devuelve el IVA a los más vulnerables Para hacerle frente a los efectos de la emergencia causada por el coronavirus, el Gobierno nacional adelantó esta medida que busca proteger y mejorar la capacidad de consumo.

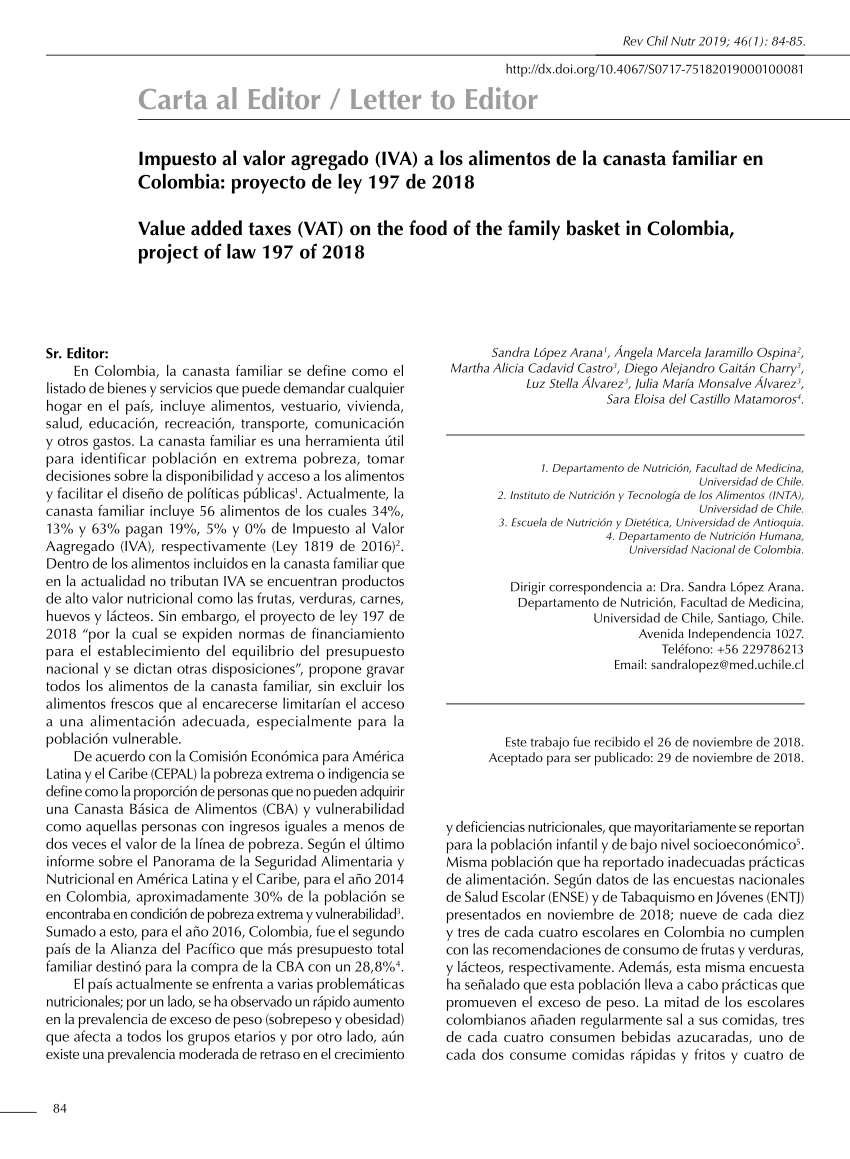

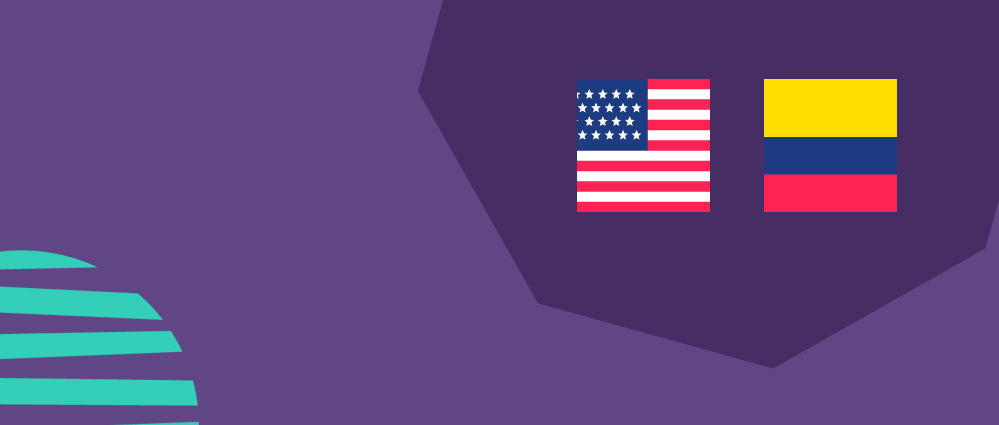

The Sales Tax Rate in Colombia stands at 19 percent Sales Tax Rate in Colombia averaged 1680 percent from 06 until , reaching an all time high of 19 percent in 17 and a record low of 16 percent in 07 This page provides Colombia Sales Tax Rate actual values, historical data, forecast, chart, statistics, economic calendar and news. Wide and varied range of Agro Product We maintain close relationships with our producers, Our Team follows up and analyses international harvest cycles, what the weather conditions and we also know exactly when harvest is taking place in order to reduce the risk of a bad harvest due or crop failureThis allows us to plan our sales in good time and permit us to offer the widest choice and. The valueadded tax (VAT) is the main indirect tax This rose to 19 percent in 17;.

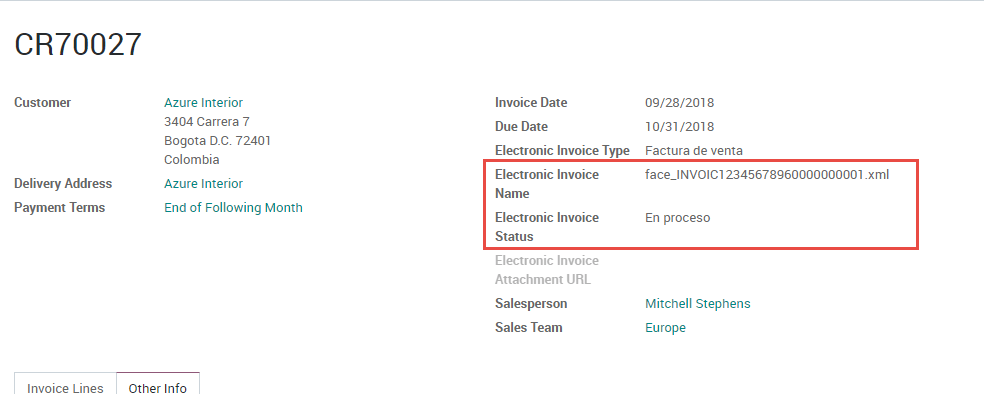

Innovating for our customers;. A registered business will be provided with a Taxpayer Identifiaction Number (“Número de Identi cación Tributaria” – NIT There is no scope for voluntary VAT registration Deregisteration must be applied for within 30 days of stopping taxable supplies, and should be supported by the certificate of a public auditor. Foreign companies rendering taxable services from abroad are required to file VAT returns in Colombia (obligation to charge VAT started as of 1 July 18 while the obligation to file returns would start as of November 18);.

If you are not VAT registered (not under regimen comun), Google will be applying a 19% Value Added Tax (VAT) on the service fee charged due to the expansion of the tax legislation in Colombia The 19% VAT charge will be reflected separately from the service fee Your tax registration status affects the taxes that you are charged in Colombia. Creating new water resources;. El número del impuesto sobre el valor añadido es un número de identificación que te permitirá realizar negocios y emitir tus facturas a empresas dentro de Europa Este es el caso de aquellas personas que, sin tener una oficina física en España, quisieran hacer cualquier tipo de actividad económica con este país (como productos de exportación).

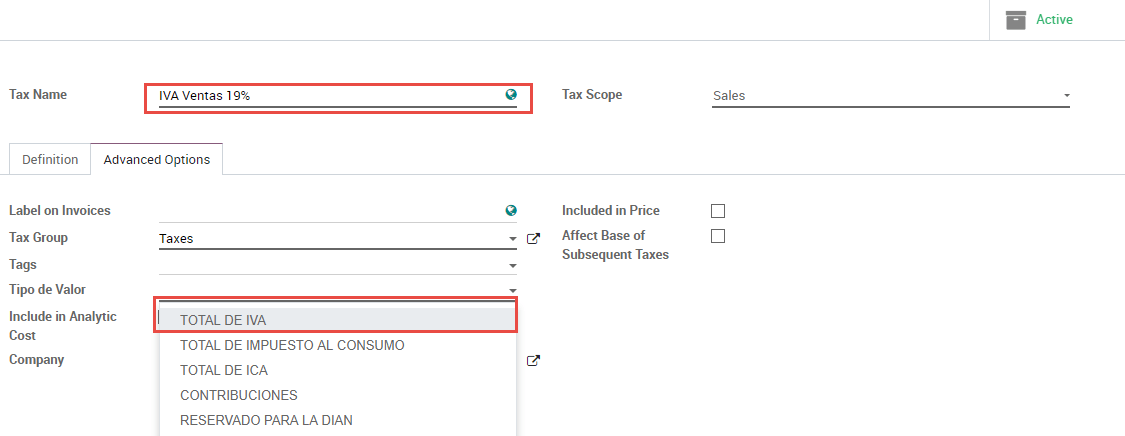

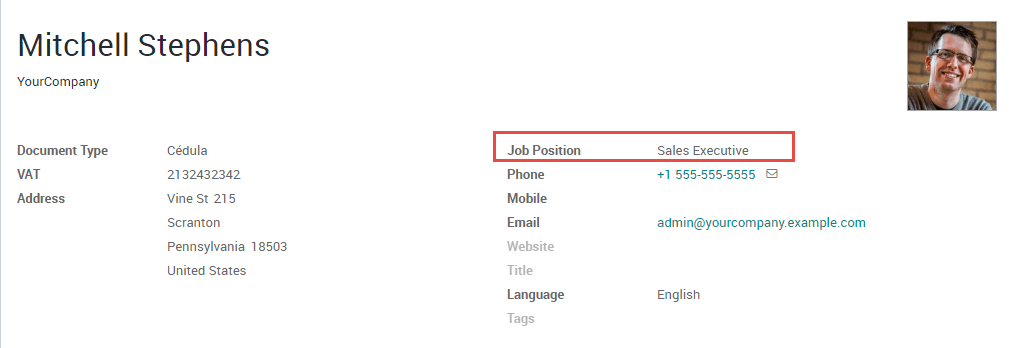

Hello, When customizing the VAT tax codes for COlombia,we have a VAT which is %. Your income tax filing date in Colombia depends on the last two digits your Colombia tax ID number, which is known as a Número de Identificacíon de Tributaria (NIT). The capital of Colombia is an attractive destination for those who wish to get to know the essence of South America This chaotic city is home to important museums such as the Botero Museum and Torre Colpatria, Mount Monserrate, and big parks such as the Metropolitan Simon Bolivar;.

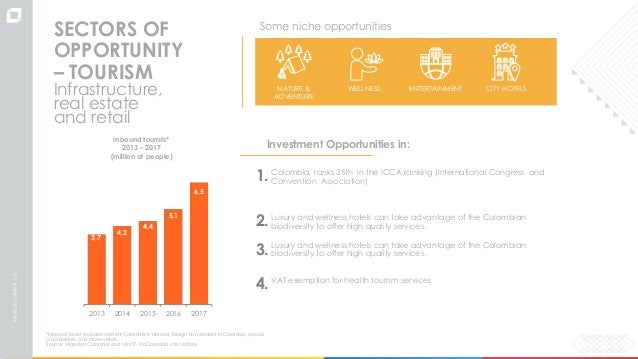

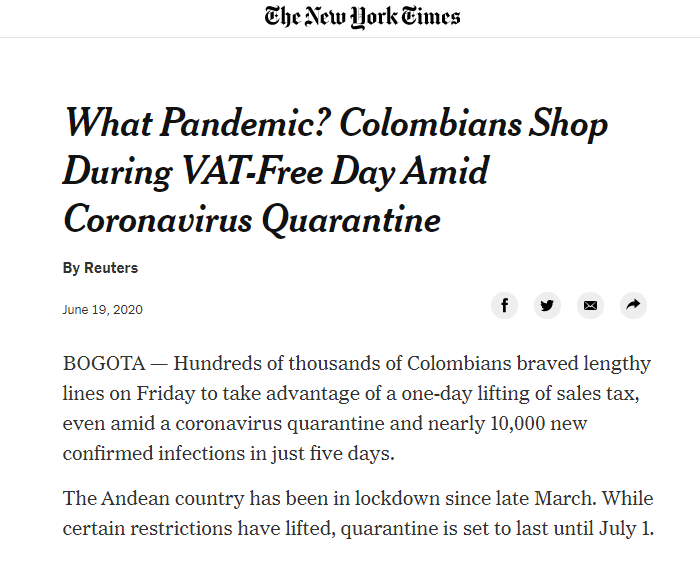

Recovery of VAT by nonestablished businesses Colombia does not refund VAT incurred by foreign or nonestablished businesses unless they are registered for VAT there How ever, members of accredited diplomatic missions and members of the United Nations may claim a refund of VAT paid Invoicing Tax credit documents, invoices and credit notes. COLOMBIA – Update 10th June Colombia Consumption Tax and VAT Relief for COVID19 Measures VAT exemption holidays for consumers on 19 June, 3 July, and 19 July ;. The valueadded tax (VAT) is the main indirect tax This rose to 19 percent in 17;.

TotalThe problem is that the general rate is 16%, and the 4%. VATSearch has more than 600 clients including By using VATSearcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries Read More Hide Contact Imprint GTC About VATSearcheu Language. Colombia issues regulation on voluntary VAT collection system for foreign service providers of digital services Foreign service providers of digital services may elect to be subject to a new valueadded tax (VAT) withholding system under which they will no longer be responsible for collecting the VAT on the provision of digital services to.

2 up to the end of 16 the tax was 16 percent of the price of merchandise, goods and services with some exceptions public transportation , water supply and sanitation and the transportation of natural gas and hydrocarbons. Colombia has a national Valueadded tax (VAT) of 16% as of 21, administered by the Dirección de Impuestos y Aduanas Nacionales (DIAN) Visit this page for an executive summary of Colombia's tax structure and rates, by SalesTaxHandbook. A national identification number, national identity number, or national insurance number is used by the governments of many countries as a means of tracking their citizens, permanent residents, and temporary residents for the purposes of work, taxation, government benefits, health care, and other governmentallyrelated functionsThe number appears on identity documents issued by several countries.

Reduction in the consumption tax rate for restaurants, cafeterias, and other similar food and beverage services is reduced from 8% to 0% until 31 December. Foreign companies rendering taxable services from abroad are required to file VAT returns in Colombia (obligation to charge VAT started as of 1 July 18 while the obligation to file returns would start as of November 18);. In Colombia, each person is issued a basic ID card during childhood (Tarjeta de Identidad) The ID number includes the date of birth and a short serial number As of 03 created the NUIP (Número Único de Identificación Personal), starting the numbering per billion (1,000,000,000) Read more about this topic National Identification Number.

A national identification number, national identity number, or national insurance number is used by the governments of many countries as a means of tracking their citizens, permanent residents, and temporary residents for the purposes of work, taxation, government benefits, health care, and other governmentallyrelated functionsThe number appears on identity documents issued by several countries. A VAT number is a registered tax identification number in tax systems that use ValueAdded Tax (VAT) When you register for VAT in a single country, you receive a VAT number for their tax system Important note A VAT number is not the same as a local tax number or tax ID A VAT number is exclusively for the ValueAdded Tax scheme. Un número VAT permite a la Unión Europea mantener registros de las actividades empresariales de negocios que importan o exportan bienes en las áreas aplicables Esta información permite el cálculo del impuesto al valor agregado que una empresa debe pagar por llevar a cabo su negocio La cantidad precisa del impuesto varía por país.

Therefore, they should be registered and should have designated an authorized signatory. A value added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value added tax purposes In the EU, a VAT identification number can be verified online at the EU's official VIES website It confirms that the number is currently allocated and can provide the name or other identifying. If you are not VAT registered (not under regimen comun), Google will be applying a 19% Value Added Tax (VAT) on the Service Fee charged due to the expansion of the tax legislation in Colombia The 19% VAT charge will be reflected separately from the Service Fee Your tax registration status affects the taxes you are charged in Colombia.

Y un número de IVA extranjero o intracomunitario a. Cómo conseguir el VAT Si una empresa necesita recibir su número de identificación europea, debe demostrar en la Agencia Tributaria que realmente necesita este número Es decir, tiene que certificar frente a un evaluador de Hacienda que guarda intención y capacidad para facturar en un país de la Unión Europea y que, en consecuencia. Mientras que este número de identificación te será válido para comercializar productos y servicios en España, a nivel europeo necesitarás el VAT para poder hacerlo Cómo conseguir el VAT La concesión o no de este número identificativo dependerá de la Comunidad Autónoma en la que residas.

VAT is the abbreviation of Value Added Tax VAT is in general due when goods and/or services are sold la dirección IP utilizada para comprar servicios digitales está en Colombia (3) el número de teléfono utilizado para la compra o el pago de los servicios digitales tiene el código de país de Colombia. Calle Las Mercedes, 31 3º 430, Getxo (34) 944 800 500 sbal@sbalnet Contacto. Therefore, they should be registered and should have designated an authorized signatory.

Olvidó de clave Si usted olvidó su clave para ingresar al servicio transaccional de Itaú, por favor comuníquese al Contact Center al 581 8181 (en Bogotá) o al 01 8000 512 633 (en el resto del país). La Comisión Europea emplea las dos expresiones VAT number y VAT identification number, en español, número de IVA y número de identificación de IVA Sin embargo, la Agencia Tributaria se refiere a él como el número de identificación fiscal (NIF) a efectos del IVA intracomunitario y opta por utilizar las siglas compuestas (NIFIVA) En las transacciones económicas entre empresas o. Tu conexión con la privacidad En un solo proyecto PRIVATTO reúne las ventajas de una gran ubicación, un amplio número de amenidades, y 50 apartamentos, todos exteriores, con acabados cuidadosamente seleccionados, y conectados a un entorno verde mediante la amplia ventaneria que caracteriza su fachada.

Encuentra en Aviancacom las mejores ofertas de vuelos a 76 destinos, ahora con $0 de penalidad en cambios de itinerarios en vuelos internacionales. Revisa tus registros Si el número que debes encontrar es el EIN de una empresa con la que hayas tenido negocios, podrías encontrarlo en las facturas de esa empresa o en otro tipo de documentación de las transacciones que hayas realizado con ella Por ejemplo, para recibir una deducción fiscal debido a que tienes hijos a tu cargo, puedes necesitar el EIN de la guardería o de la niñera. VAT returns are bimonthly in Colombia for businesses with revenues of 3 billion pesos per annum For smaller taxpayers, returns are quarterly The penalty for late VAT returns and payments is 5% of the value of the VAT due.

Colombia’s consumer confidence sank to a record low in January last year, after the government of President Juan Manuel Santos raised VAT to 19 percent from 16 percent. Colombia VAT information Name of the tax Valueadded tax (VAT) Local name Impuesto sobre las ventas (IVA). El número de identificación fiscal federal para Microsoft es El número de identificación fiscal federal se usa con fines fiscales Los clientes también pueden obtener este número llamando a ventas de consumidor de Microsoft en (800).

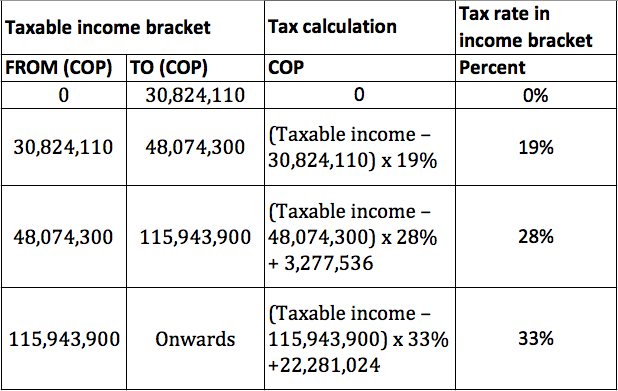

VAT halfempty Colombia tries to fix a messy and unfair tax A scheme to help the poor, and raise more revenue for the government The Americas Oct 17th edition Oct 17th. En Colombia, tengan vigente el Sistema Técnico de Control Tarjeta Fiscal 36 No Factura Escriba el número de la factura de la cual solicita la devolución del impuesto sobre las ventas por las compras de bienes gravados 37 Fecha factura Escriba la fecha de la factura de la cual solicita la devolución. Note that Colombia taxes worldwide income, just like the United State does When to File Income Taxes in Colombia?.

Un número de registro de IVA es alfanumérico y consta de hasta 15 caracteres Las primeras dos letras indican el estado miembro correspondiente, por ejemplo, DE para Alemania Al introducir su número de IVA, deberá incluir las dos letras que identifican a su estado miembro de la UE (por ejemplo, DK para Dinamarca, EL para Grecia y GB para. La configuración del dispositivo siempre está sujeta a lo predeterminado por el operador, es por eso que en ocasiones la opción de oculto falla En Colombiacom te indicamos 3 maneras para aprender a llamar como número privado Te puede interesar Facebook ¿Cómo transmitir en vivo desde tu computadora?. Physically rendered in Colombia are subject to VAT Nevertheless, some exceptions are provided regarding services rendered from abroad by nonresidents to users or recipients located in Colombia, such as auditing, consulting, advisory and licensing of intangible goods, which are considered to be rendered in Colombia and therefore levied with VAT.

El Número de Identificación Fiscal (NIF) es la manera de identificación tributaria utilizada en España para las personas físicas (con documento nacional de identidad o número de identificación de extranjero asignados por el Ministerio del Interior) y las personas jurídicas 1 cita requerida El antecedente del NIF es el CIF, utilizado en personas jurídicas. Zoom is the leader in modern enterprise video communications, with an easy, reliable cloud platform for video and audio conferencing, chat, and webinars across mobile, desktop, and room systems Zoom Rooms is the original softwarebased conference room solution used around the world in board, conference, huddle, and training rooms, as well as executive offices and classrooms Founded in 11. 2 up to the end of 16 the tax was 16 percent of the price of merchandise, goods and services with some exceptions public transportation , water supply and sanitation and the transportation of natural gas and hydrocarbons.

Colombia has so far been less affected by the disease than its neighbors, with 60,000 confirmed infections, compared to 225,000 in Chile, 244,000 in Peru and 978,000 in Brazil For more articles. Cannot be deducted in the VAT declaration, it has to be charge as an aditional cost to the base. Standard VAT rates for WWTS territories This table provides an overview of statutory VAT rates In instances where a territory has a consumption tax similar to a VAT, that tax rate is provided See the territory summaries for more detailed information (eg exempt items, zerorated items, items subject to a reduced rate, alternative schemes).

The Sales Tax Rate in Colombia stands at 19 percent Sales Tax Rate in Colombia averaged 1680 percent from 06 until , reaching an all time high of 19 percent in 17 and a record low of 16 percent in 07 This page provides Colombia Sales Tax Rate actual values, historical data, forecast, chart, statistics, economic calendar and news. Standard custom duties for import consist of 19% VAT (however, certain services and goods are taxed only 5% and 0%) and tariffs consist of three levels 0% to 5% on capital goods, industrial goods, and raw materials not produced in Colombia, 10% on manufactured goods, and 15% to % on consumer and sensitive goods. Optimizing the management of water and wastewater treatment networks.

Colombia has confirmed the liability for foreign suppliers to register, collect, and remit VAT at 19% in Colombia effective since January 1, 19 for sales to individuals Many foreign suppliers of digital services may benefit from an exemption provision for digital content Incountry tax advice is needed to understand if a particular. Without domicile in Colombia, responsible for sales tax (VAT, they may submit the application for the registration, updating or cancellation of the Single Tax Register (RUT) through the "PQSR and Complaints" service of the website of the Special Administrative Unit Directorate of National Taxes. Colombia has a national Valueadded tax (VAT) of 16% as of 21, administered by the Dirección de Impuestos y Aduanas Nacionales (DIAN) Visit this page for an executive summary of Colombia's tax structure and rates, by SalesTaxHandbook.

Hotel In Cartagena Ibis Cartagena Marbella All

Revistas Unilibre Edu Co Index Php Dictamenlibre Article Download 5142 4360

Tax Information Help Apple Search Ads Basic

Numero Vat Colombia のギャラリー

National Identification Number Wikipedia

Vre

How To Get A Eu Vat Number Vat Registration Quaderno

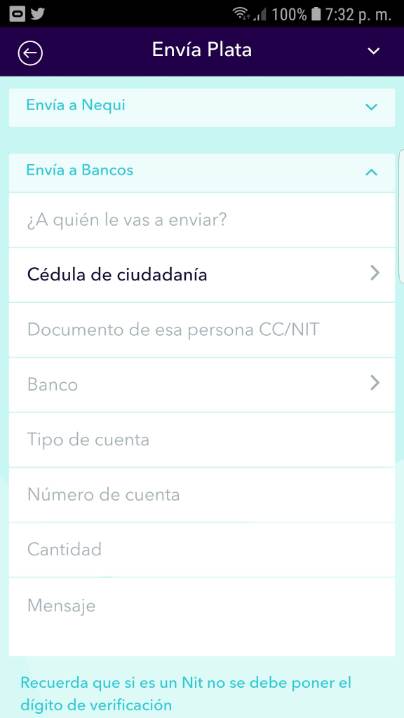

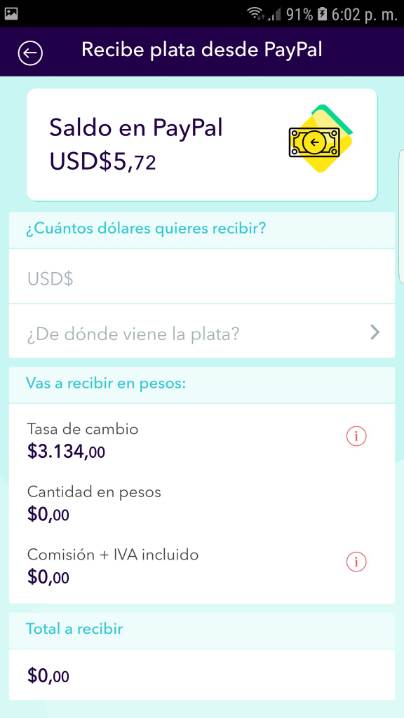

How To Withdraw Money From Paypal To A Bank Account In Colombia Using Nequi Our Code World

Ministerio De Relaciones Exteriores Normograma Resolucion 1 De 15 Dian Direccion De Impuestos Y Aduanas Nacionales

Voec Vat On E Commerce In Norway Ecovis Explains

Pdf Determinants Of Book Reading And Library Attendance In Colombia A Microeconometric Approach

Filing Colombia Income Taxes 16 Update

How To Get A Eu Vat Number Vat Registration Quaderno

Www Ciat Org Biblioteca Seminariosytalleres 12 Workshoponexchangeofinformation Eoi 16 17 Socoroo Velazquez Ciat The Use Of Tins Reply To Eoi Requests Pdf

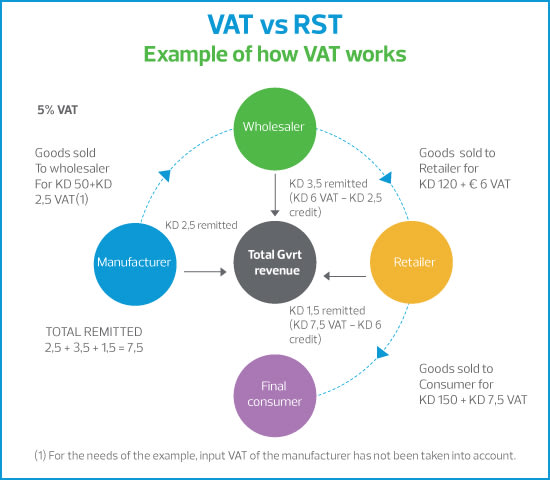

What Is Vat Rsm Kuwait

Auto Validate Vat Number In Customer Group Prestashop Addons

How To Get Your Vat Value Added Tax Refund In Ecuador For Foreign Tourists Josephle Com

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

Q Tbn And9gcqxue2akr4gudopyrdosmfbtk2 Uuherdhmonxfz8o97zbp 3wt Usqp Cau

Www Pwc Com Gx En Tax Indirect Taxes Assets Guide To Vat Gst Sut In The Americas 18 Indirect Tax Guidance Of 21 Countries In The Americas Pdf

The 16 Tax Reform In Colombia A Patchwork Quilt

Paginas Prestadores De Servicios Desde El Exterior

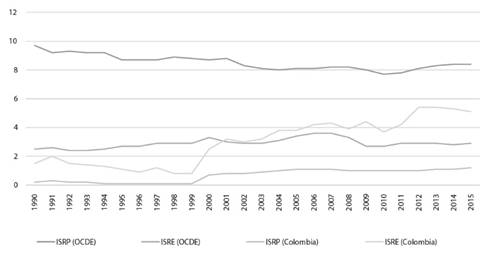

Situacion De La Tributacion En Centroamerica Y La Armonizacion Del Iva En Los Paises Andinos By Idb Issuu

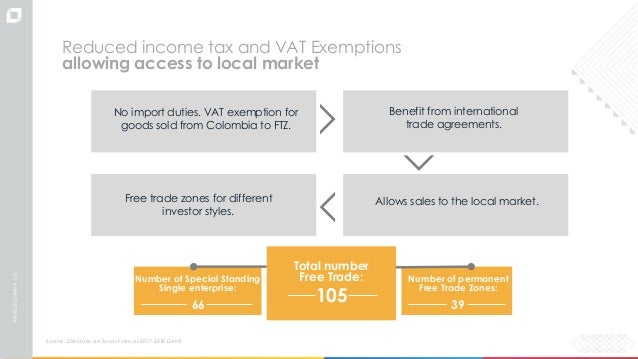

Colombia Presentation For 19

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

Devoluiva Vat Refund Invoice

Q Tbn And9gcrpmdbf9wdq0okpfz12uzyz Mpcvhi9xggqe6qj3a6vyvsk8gk6 Usqp Cau

Pdf Comportamiento Del Iva En El Transporte Aereo De Pasajeros Colombia Peru Periodo 02 17 Vat Behavior Air Transport Of Passengers Colombia Peru Period 02 17 Contenido

How To Withdraw Money From Paypal To A Bank Account In Colombia Using Nequi Our Code World

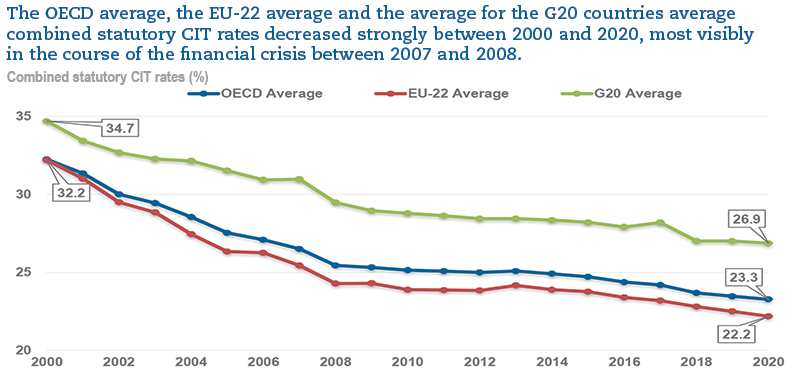

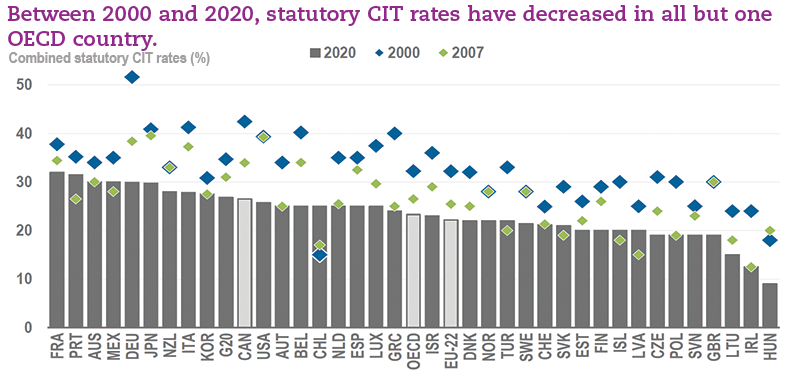

Oecd Tax Database Oecd

Colombia Odoo 14 0 Documentation

Colombia Tax Collection Internal Vat Economic Indicators

Http Repository Ucc Edu Co Bitstream 500 7996 1 El iva a trav C3 s del tiempo en colombia Pdf

Vat In Portugal Portugese Vat Rates Number Registration Vatglobal

Filing Colombia Income Taxes 16 Update

Colombia Presentation For 19

Www Pwc Com Gx En Tax Pdf A Guide To Vat Gst Sut In The Americas Pdf

Que Es El Vat Number Para Que Sirve Como Solicitarlo

Numero Vat Que Es Y Como Se Tramita Holded

Www Pwc Com Co En Publications Doing business english version Pdf

Pdf Impuesto Al Valor Agregado Iva A Los Alimentos De La Canasta Familiar En Colombia Proyecto De Ley 197 De 18

Vre

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

The 16 Tax Reform In Colombia A Patchwork Quilt

Bulgaria Cuts Vat Rate To 9 On Books And Restaurant Services

Colombians In The Usa How To Feel At Home

All For One Steeb Vat Number Validation Erp For Small And Midsize Enterprises

Tranet Certified Translation Of A Certificate Of Conduct From Spanish To English

Http Www Propuestasparaeldesarrollo Com Inicio Index Php Ppd Article Download 17 43

Oecd Tax Database Oecd

2

Colombia Vat Zoom Help Center

Que Es El Vat Y Como Tramitarlo Circulantis

How To File Income Taxes Declaracion De Renta In Colombia

Colombian Vat Guide Avalara

European Vat Number Prestashop Addons

Solidarity Income Dnp Gov Co Consult Incomesolidario Social Prosperity Return Vat Deduction Fifth Round Today September Daviplata Banco Agrario

Colombia Tax Collection Internal Vat Economic Indicators

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

All For One Steeb Vat Number Validation Erp For Small And Midsize Enterprises

Colombia Odoo 14 0 Documentation

Colombia Indirect Tax Guide Kpmg Global

Colombians In The Usa How To Feel At Home

Colombia Odoo 14 0 Documentation

Starting A Business In Colombia And Getting The Investment Visa A Step By Step Guide

Oecd Tax Database Oecd

European Vat Number Prestashop Addons

Www Dian Gov Co Tramitesservicios Tramites Impuestos Documents Instructivo Iva En El Exterior Vr English Pdf

The 16 Tax Reform In Colombia A Patchwork Quilt

Covid 19 Pandemic In Colombia Wikipedia

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

Vat Registration In Portugal

Senegal Vat Changes 18 Wts Global

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

Un Iva De 19 En La Canasta Familiar Le Daria Al Gobierno Unos 15 3 Billones

How Import Taxes Work Vat Duties And Customs Clearance Vatglobal

How To Withdraw Money From Paypal To A Bank Account In Colombia Using Nequi Our Code World

:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/QVR4MMYGAJDZ5NOFC36BRDZTDM.jpg)

Arranco El Dia Sin Iva Que Comprar Y Que No Durante La Jornada Infobae

Competition Adesignaward Com Document Download Php Id 143

Www2 Deloitte Com Content Dam Deloitte Es Documents Fiscal Deloitte Es Fiscal Boletiniva 1904 Pdf

Colombia Presentation For 19

Home All Vat Services

Dialnet Unirioja Es Descarga Articulo Pdf

Vre

European Vat Number Prestashop Addons

Www Pwc Com Gx En Tax Indirect Taxes Assets Guide To Vat Gst Sut In The Americas 18 Indirect Tax Guidance Of 21 Countries In The Americas Pdf

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

Colombia Presentation For 19

What Is Vat Rsm Kuwait

Colombia Los Productos Que No Tendran Iva Durante 3 Dias Folou

European Vat Number Prestashop Addons

Devoluiva Vat Refund Invoice

Revistas Usantotomas Edu Co Index Php Cife Article Download 3134 3131

Dia Sin Iva Bloomberg Y The New York Times Le Cuentan Al Mundo Sobre El Covid Friday Forbes Colombia

Revistas Uniminuto Edu Index Php Iyd Article Download 1526 1475

Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Azerbaijan Tin Pdf

Coronavirus En Colombia Resumen De Las Noticias Contagios Y Muertos De Covid 19 Durante El De Junio Marca Claro Colombia

Canada To Tax Digital Services Provided By Foreign Companies

Colombia Odoo 14 0 Documentation

Http 192 167 108 132 Img Vat By Countries Pdf

Colombia Presentation For 19

How To Get A Eu Vat Number Vat Registration Quaderno

Business Procedures In Rwanda